Retirement Savings – Why You Must Start Now

Key Points:

- Most do not save enough to maintain their quality of life upon retirement.

- The lost opportunity cost of money causes the most damage.

- How much you need to save to meet your retirement goal.

From graduation to retirement, the average person spends over 90,000 hours at work. We toil away a third of our lives until the economy decides we’ve contributed enough and can spend the rest of (what’s left of) our lives enjoying the fruits of our labor.

For many, however, there are very few fruits to enjoy. In the US, just 16% save more than 15% of their income – an amount experts generally recommend to maintain a similar quality of life once retired. 59% of Americans said they accept that they will have to keep working past retirement age, while 36% suppose that they will never be able to save enough to retire.

We all know that building a nest egg for retirement is critical, but few understand just how vital it truly is. Payday arrives, and the temptation to spend is irresistible. After all, what’s the point of working if you cannot indulge? Why should you not be able to enjoy your money while still young?

While this may sound reasonable, life is not always fair. Getting old can be challenging in itself, but it will be downright brutal without the necessary resources to make yourself comfortable.

Humans are Wired to be Bad Savers

We are hardwired to do things wrong with money – literally. When our ancestors lived in hunter-gatherer societies, we only concerned ourselves with what we could carry. There were no freezers or other means of storage and collection. We foraged what we needed and didn’t think much about it until it was time to repeat the process.

In the summer, bears eat all the salmon they can forage; they do not care about getting fat or the cardiovascular effects of carrying all that weight. All they care about is obtaining enough calories to survive the winter. In the same way, it is naturally difficult for us to think about saving money beyond what we need in the short term.

Saving for the future is a relatively new concept in our evolution, so the ability to purposely delay gratification and save for the long, distant future is not something that comes naturally.

But where we differ from other animals is in our ability to consciously think about the future. We, therefore, have to be consciously aware of the importance of saving and go out of our way to put in place steps that ensure we save consistently.

Savings Buy You Freedom

While most acknowledge the importance of saving money now to ensure we have ample funds in the future, few truly understand the importance and immense power of saving hard and, in particular, saving early.

If they did, they almost certainly wouldn’t lease a brand-new German car after just a couple of months of working, as seems to be the trend in an era of low-interest car leases.

Obvious financial advantages aside, savings provide a higher degree of freedom. Your savings, believe it or not, affect the way you stand, the way you walk, and ultimately your physical well-being and self-confidence. A person without savings is always running.

They must take the first job offered, no matter how much they might not want to. They have no options; without cash, they cannot afford the essentials. They always feel on edge as any unforeseen event can throw them into financial despair.

Savings are a powerful tool to buy a greater degree of freedom. If your boss frustrates you or applies unfair pressure at work, you have the option of walking away without worrying about the next six months of bills. Even if you don’t quit, the knowledge that you could is liberating in itself, and mitigates a lot of potential anxiety.

If your car starts giving you problems, you have the option to fix or replace it. The freedom that options provide is invaluable and relinquishes much anxiety that crushes others. When living paycheck-to-paycheck, you’re really just an indentured worker, because while you can technically quit your job, there is immense pressure not to. That’s financial duress.

Savings Instill Discipline

Saving young also imprints a good sense of discipline that stays with you throughout the rest of your life. Children tend to pick up financial habits from their parents, meaning you are also investing in your children’s futures by instilling good financial practice.

Those who have savings have also been found to live longer on average. The life expectancy for a man born in 1950, for example, is 73 for the poorest 10% and 87 for the wealthiest 10%. A similar gap was also found for women. There could be a myriad of reasons why this is the case, but it is likely that those with financial discipline are also likely to be disciplined with their health.

Fail to Prepare, Prepare to Fail

The number of people without sufficient retirement funds is frightening. The average pension pot for those aged between 55-64 in the US is just $107,000. While this might sound like a lot, at a typical 4% withdrawal rate, this would result in just $357 a month to live on, for the rest of your life.

A person in this category would be wholly dependent on the 2022 state social security monthly payment of $1,657 for a total income of just $2,014 a month, or $24,168 annually. Not exactly the retirement funds many would come to expect after a life of hard work. Even more worryingly, new data from Northwestern Mutual’s 2019 Planning and Progress Study found that 15% of Americans have no retirement savings at all.

Experts recommend amassing between $500,000 and $1 million US dollars by the time of retirement for a comfortable pension income, although increasing inflation and general cost of living increases will likely raise this significantly.

Assuming a widely accepted withdrawal rate of 4%, this will leave an annual income of $20,000 for a $500,000 pot and $40,000 for a $1 million pot, plus any social security to which you may be entitled. For many, this would be just enough to maintain the lifestyle that they’ve become accustomed to, especially once mortgages and loans are paid off.

Your Free Book is Waiting

You’ll Learn:

- How to Create Habits – The Right Way

- Create a Bulletproof Plan to Achieve Your Goals

- Master the Art of Failing

- Rediscover Your Love of Learning

- Instantly Become More Personable

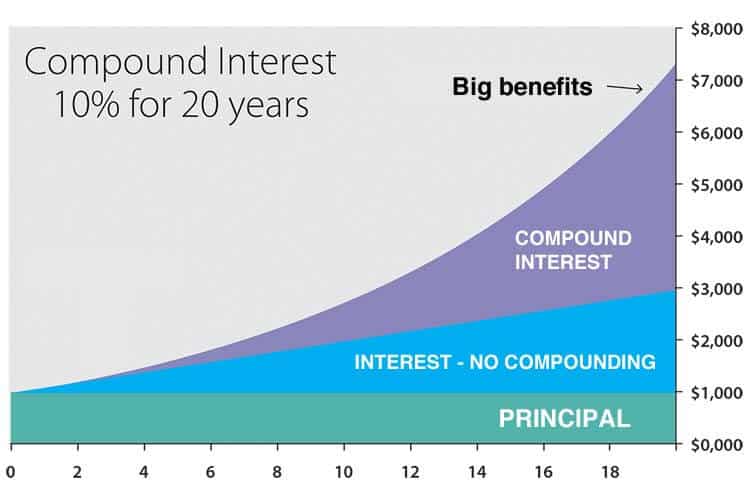

Time + Compound Interest = Wealth

Saving such great sums for retirement may sound unrealistic, especially for lower earners. Yet there is one aspect of life that can help anyone get there; time. If you start saving at 25, you have to save roughly $500 per month to hit $1 million by age 65 (assuming a conservative 6% annual return on pension funds).

The more time this money can sit and accumulate interest, the less needs to be contributed. Starting just 10 years later at age 35, however, increases the monthly contribution to $910, almost double. Another 10-year delay would double this again, to an eye-watering $1850.

The earlier you start saving, the more time will work for you, compounding your funds with each passing year. Such is the power of time and compound interest that it becomes exponentially more challenging to catch up with each passing decade. However, the best time to start saving is NOW. No matter your age, maximizing your time has to begin as soon as possible.

For those interested, play around with the numbers using this handy compound interest calculator.

Put off Those Expensive Leases

Spending $500 per month on a new car lease at age 20 for two years may not seem like much; $12,000 over a 50-year career may seem like a drop in the ocean. But the opportunity cost of that money is rarely considered, and this is where the real damage starts.

Were you to invest this same monthly contribution in a simple and safe index fund, the simplest and most risk-averse investment over the long term, this initial $12,000 would magnify into $177,361 by the time you retire at 65. At a 4% average withdrawal, this would yield nearly $600 a month in interest, a payment that would be made to you for the rest of your life.

With an average life expectancy of 79, this initial $ 500-a-month car lease would wipe out nearly $110,000 in income alone. By 65, that car you bought at 20 would barely be a memory, but the extra $600 it provides every single month will afford you many options.

Many would argue that a car is a necessity, which may be true. But leasing a perfectly capable Toyota Camry instead of a BMW, a price difference of $250 per month, would lead to an extra $88,680, or a perpetual retirement income of $296 a month for the rest of your life.

It can be hard to think like this – remember, humans are not hardwired to think long-term – but I guarantee when you retire and must rely on the state for survival, it will be a mistake that will haunt you to your grave.

Spending is More Expensive Than You Think

Another typical blunder is dedicating the first ten working years to “living life” and “having fun while you’re young”. While this is certainly important (youth is one of the most valuable assets that money cannot buy), failing to save enough in these early years can prove to be a life-changing mistake later on. Let’s look at an example:

Michael saved $1,000 per month from the time he turned 25 until he turned 35. Then he stopped saving but left his money in his investment account where it continued to accrue at a 7% growth rate until he retired at age 65.

Jennifer held off and didn’t start saving until age 35. She put away $1,000 per month from her 35th birthday until she turned 45. Like Michael, she left the balance in her investment account, where it continued to accrue at a rate of 7% until age 65.

Sam didn’t get around to investing until age 45. Still, he invested $1,000 per month for ten years, halting his savings at age 55. Then he also left his money to accrue at a 7% rate until his 65th birthday.

Michael, Jennifer, and Sam each saved the same amount ($120,000) over ten years. Sadly for Jennifer, and even more so for Sam, their ending balances were dramatically different. At retirement, Michael amassed $1,444,969. Jennifer attained $734,549, while Sam ended up with just $373,407. All made the same time and monetary commitments, but the outcomes were life-changing.

Just by using time to his advantage, Michael became a millionaire at retirement, despite investing the same amount over the same 10-year period. Sam, on the other hand, will have to rely on the state for the rest of his life.

While it is almost certainly more difficult to save $1000 during your 20s than in your 30s and 40s (the prime earning years), the results speak for themselves, and sacrifices have to be made to ensure a comfortable life when you need it most.

Enjoyment and savings are not mutually exclusive. You do not have to forgo all sense of fun and enjoyment to stow money away into savings. But a compromise must be made and made as soon as possible.

Leasing that slightly cheaper car or mortgaging that slightly smaller first house could be the difference between financial freedom or financial hell come retirement. Experts recommend saving between 10 and 15% of your monthly paycheck into a retirement fund, although recent inflation is bringing this closer to 20%. But anything is better than nothing.

Conclusion

Whatever your position, you need to find some way of saving even $100 a month. Even this smaller sum, when saved monthly between 25 and 65, will grow to almost $200,000 at retirement. For those who are older and are yet to start saving, you still need to maximize time as best you can by contributing as much as possible. Now is the only correct time to start investing, and your future self is depending on it.

Let me know your thoughts in the comments below!

Feeling Overwhelmed? Regain Control With These Simple Tips

Modern life can quickly leave you feeling overwhelmed if you are not prepared. Learn how to overcome these feelings and stay in control of your time

5 Treatments for ADHD – Prescription, Stimulant, Natural, and Non-Invasive

Treatments for ADHD include prescription medication, natural stimulants, natural non-stimulants, and non-invasive techniques. The best course of action, however, depends on the individual.

Retirement Savings – Why You Must Start Now

Retirement will come sooner than you imagine. Learn why building retirement savings is vital and how much you need to start saving today.

5 Powerful Ways to Boost Your Social Skills Today

The success you attain in life depends largely on the strength of your social skills. Here are 5 of the most powerful ways you can boost yours today.

Nutritional Psychiatry – Foods the Brain Needs for Success

The brain needs many foods for success; a lack of any one of the hundreds of nutrients will result in poor cognitive health and performance.

The Fiber Fallacy: Do You Really Need Fiber?

Do you really need fiber, or is this simply an overhyped myth? Science and anecdotal evidence now suggest the body can run better without it when on a low-carbohydrate diet.